Good News for SMEs: e-Invoicing Pushed to 2026

The Inland Revenue Board of Malaysia (LHDN) has officially announced a rescheduling of the e-Invoicing implementation timeline for micro, small, and medium enterprises (MSMEs). Businesses with annual turnover below RM5 million now have more time to prepare, following the updated phased rollout plan released on 5 June 2025.

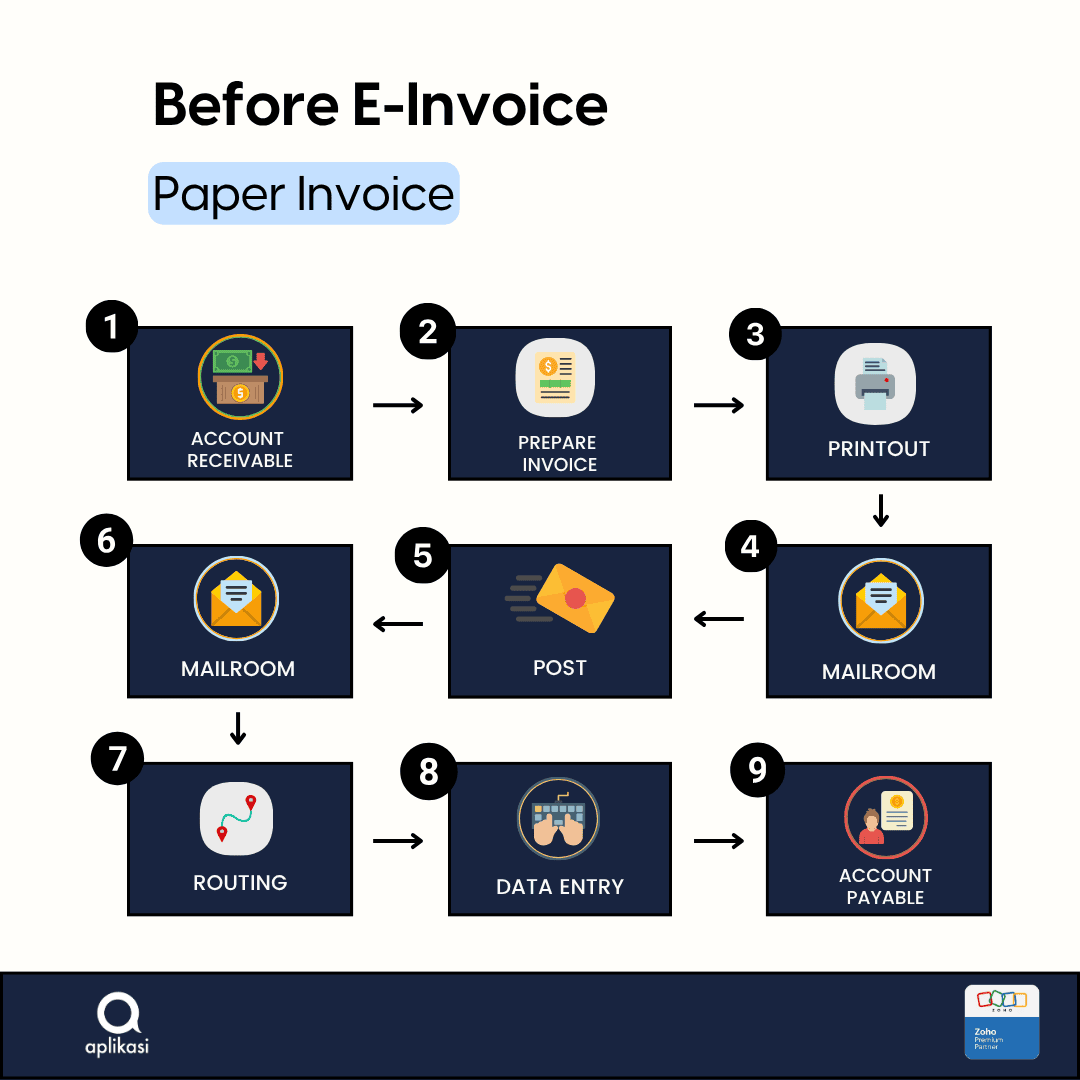

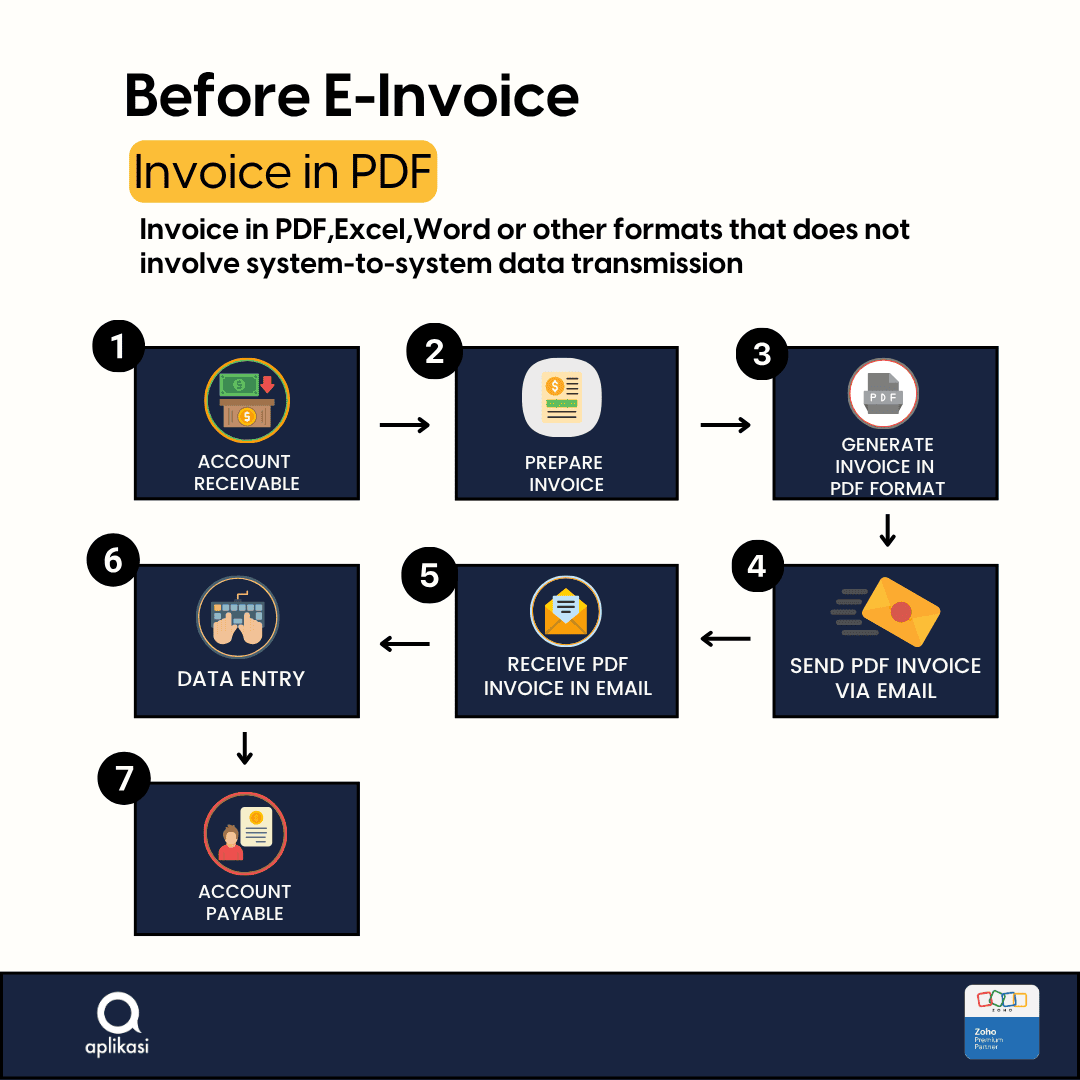

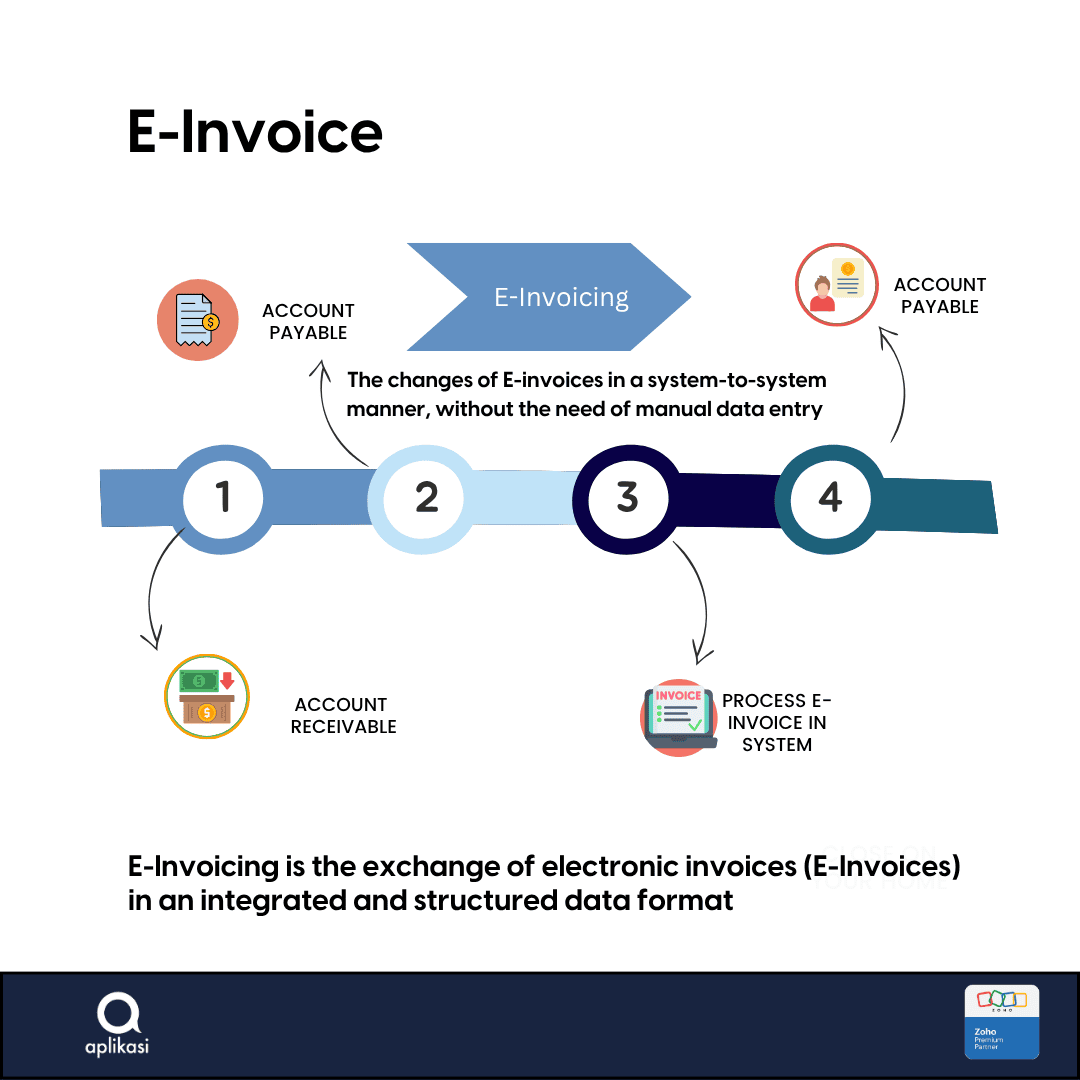

What Is e-Invoicing?

e-Invoicing is part of the government’s wider digital transformation initiative to improve tax compliance, transparency, and efficiency. Under this system, all invoices must be issued, received, and stored electronically in a standardized format, and submitted in real time to LHDN.

Updated e-Invoicing Timeline

| Annual Turnover | Mandatory Implementation Date | Grace Period Ends |

| RM100 million and above | 1 August 2024 | 31 January 2025 |

| RM25 million – RM100 million | 1 January 2025 | 30 June 2025 |

| RM5 million – RM25 million | 1 July 2025 | 31 December 2025 |

| RM1 million – RM5 million | 1 January 2026 | 30 June 2026 |

| RM500,000 – RM1 million | 1 July 2026 | 31 December 2026 |

| Below RM500,000 | Exempt till further notice | NA |

What Happens During the Grace Period?

For 6 months after your scheduled start date, the following apply:

- You can issue consolidated e-Invoices (including self-billed types).

- You may customize the “Product/Service Description” field freely.

- Upon buyer request, issuing just one e-Invoice per day (not per transaction) is acceptable.

No penalties will be enforced under the Income Tax Act during this time — provided you adhere to the above.

After the Grace Period Ends?

From January 2026 onward, you must issue one e-Invoice per transaction for any sale exceeding RM10,000. Consolidated e-Invoices will not be allowed for such transactions.

Why the Rescheduling?

- To give smaller businesses more time to adopt or upgrade digital systems.

- To reduce compliance stress for micro and small enterprises.

- To ensure service providers and technology platforms are fully ready to support a broader rollout.

What Should SMEs Do Now?

Even with the new timeline, businesses are strongly encouraged to start preparing early:

- Begin evaluating or upgrading to accounting systems that support e-Invoicing.

- Understand the LHDN e-Invoice format and submission requirements.

- Train internal staff and identify service providers who can assist with implementation.